Don't miss out on insightful articles from DalalStreetBulls. Subscribe to our substack newsletter to get weekly insights straight to your mailbox!

It is estimated that 5 crore farmers in India are involved in sugarcane farming. India is the 2nd largest producer of sugar in the world, with a 20% share of the global sugar industry. Brazil dominates the global sugar market with a ~ 42% share. Asian countries account for 34% of the global sugar production and 41% of the global sugar consumption. As per Jan ‘21 data, India had 487 operational sugar mills (up from 440 a year back). The number of installed mills is 700+. Nearly 80% of India’s sugar mills are in 3 states - Maharashtra, Uttar Pradesh and Karnataka.

Sugarcane is a long duration crop and is labour intensive. The crop can be harvested just once a year and the farmer lets go of two crops (Rabi and Kharif) to grow sugacane. It is also extremely water intensive and the Marathwada region of Maharashtra faces scarcity of water (and experts say it could be headed towards desertification) because of the sugar plantations. So why do farmers love sugarcane farming?

Well, it yields more to the farmers. The sugar mills also pre-book the harvest which provides better revenue visibility to the farmers. The cost per hectare for sugarcane is around Rs 40,000. The per hectare net returns from Sugarcane is around Rs 55,000 to Rs 65,000 depending on the region and the same from cotton and grams is just Rs 2,100 to Rs 3,100! If a farmer in Uttar Pradesh grows paddy and wheat instead of sugarcane, his net return per hectare would be ~ Rs 15,000 only. Because of higher MSP from the Government, sugarcane provides financial stability to the farmers. The domestic price of sugarcane in India is much higher than it is in other countries and it makes exporting sugar difficult for India as the pricing isn’t competitive. Although the Government has set a 60 lakh tonnes target in FY21 for sugar exports, the mills have been able to book only 25 lakh tonnes, despite the subsidies from the Central Government.

Sugar mills and sugarcane farms are usually in close proximity because of restrictions on the area where a farmer can sell. The mills pay a FRP (Fair and remunerative price) to the sugarcane farmers and the mills process the sugar canes into sugar and sell it in the market. Sugar recovery is around 10% to 12% of the sugarcane crushed. One key byproduct of the production process is Ethanol and the Government fixes the minimum selling price of Sugar. The FRP and MSP follow calculations set by the Government and have many variables. Some of India’s biggest sugar companies are EID Parry, Balrampur Chini, Dhampur Sugar and Dalmia Bharat Sugar.

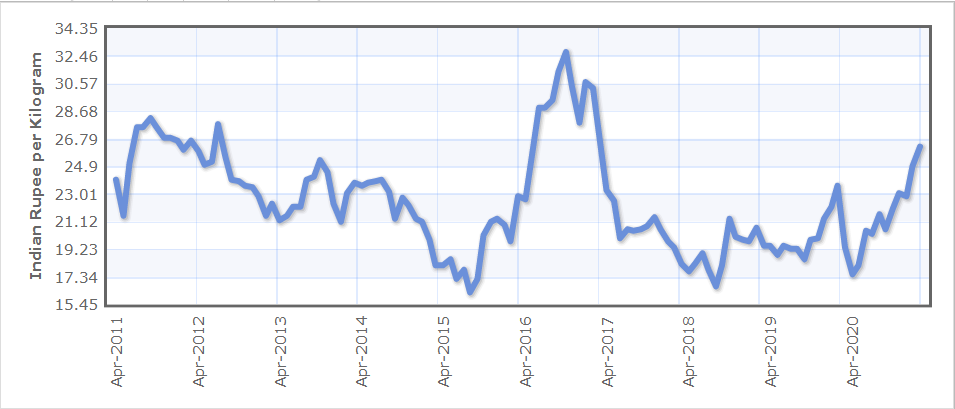

If you look at the chart of international sugar prices in INR, you will see a strong element of cyclicality. Adjusted for the MSP, ex-mill prices in India too fluctuate every year. Its simple economics, when there is a bumper harvest, the prices go down and when there is a low output then prices go up.

Sometimes, the selling price of sugar drops well below the cost of production, leaving the sugar mills with losses. Mills end up selling the sugar below the MSP to clear the inventory and also pay the FRP dues to farmers. (if not, they would be in deep trouble with the Government - Sugarcane farmers make up a major voter base). However, the dues to the farmers can build up and these arrears run in thousands of crores.

Ethanol

Ethanol is the key by-product for the sugar mills. 1 tonne sugar can produce around 11 litres of Ethanol as the byproduct. B-Heavy molasses have a higher yield but this category of molasses weren’t used much earlier.

Crude oil is India’s biggest import. This costs us a lot of foreign exchange and also makes us a net-import nation. To reduce dependency on Crude Oil, the Government in 2017-18 came up with the National Policy on Biofuels (2018)1. Under this ambitious plan, the Government aims to achieve a target blend rate of 10% by 2022 and 20% by 2030 for petrol and 5% for biofuels. The target has now been revised to 20% by 2025. Till 2017, the blend rate was ~ 2% only for petrol. A blend rate of 20% would mean 80% petrol and 20% fuel. This blending would reduce our dependency on crude oil imports. India has enough capacity to meet its Ethanol demands.

1 Crore litre of ethanol helps save ~ Rs 30 Crores of forex. In 2020-21, around 300 Crore litres of ethanol had been contracted, helping India save ~ Rs 9,000 Crores of forex.

Ethanol blending has played a key role in making the Brazilian sugar industry financially sustainable and stabilizing the cyclicality of the industry. Over the last 4 decades, ethanol production in Brazil has jumped from 0 to more than 500 million litres. Now, less than 50% of sugarcane is used for producing sugar and majority of the crop is for producing ethanol.

To achieve a 10% blend, India would need ~ 685 Crore litres of ehtanol. To achieve the 2030 (now revised to 2025) target, India would need an additional 1000 Crore litres capacity. To aid this capacity expansion, the Government has come up with a Rs 8,640 Crore package wherein the Government would either subsidize by 50% or completely bear the interest charged by banks on loans taken for capex in ethanol value chain.

India’s sugar production is around 320 Lakh MT against a domestic consumption of 260 Lakh MT. The excess 60 Lakh MT causes Rs 19,000 crores of arrears for the industry and affects the ex-mill prices of sugar. By encouraging ethanol production, the Government would incentivize the reduction of sugar production by diverting capacities towards ethanol production. The prices set by the Government for various sources of ethanol in 2021 are as follows2:

- C-heavy molasses: 45.69 / ltr

- B-heavy molasses: 57.71 / ltr

- From sugar: 62.65 / ltr

As long the price gap with petrol is attractive enough for OMCs to buy the ethanol, transport it to depots and mix it with petrol, the demand will help cushion the cyclicality in the sugar industry.

The sugar companies in India have diverted capacities to B-heavy molasses and direct cane route, thus leading to higher profitability. Increasing diversion to ethanol over next few years, will help stabilize the inventory in the industry and keep the sugar realizations stable, thereby reducing the volatility. Ethanol currently makes up ~ 12% to 17% of the revenues of the sugar mill companies.

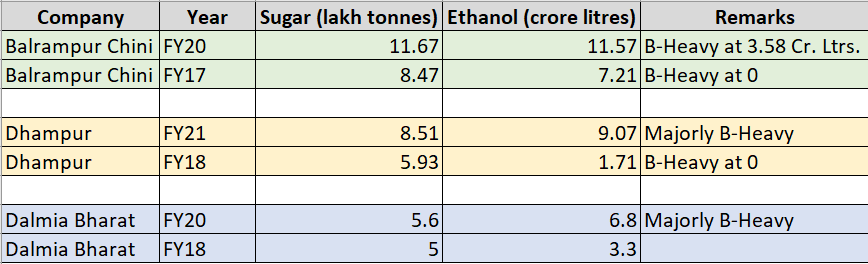

From 2017-18, the companies have aggressively shifted capacities from sugar to ethanol and increased the share of B-heavy molasses to boost EBITDA margins.

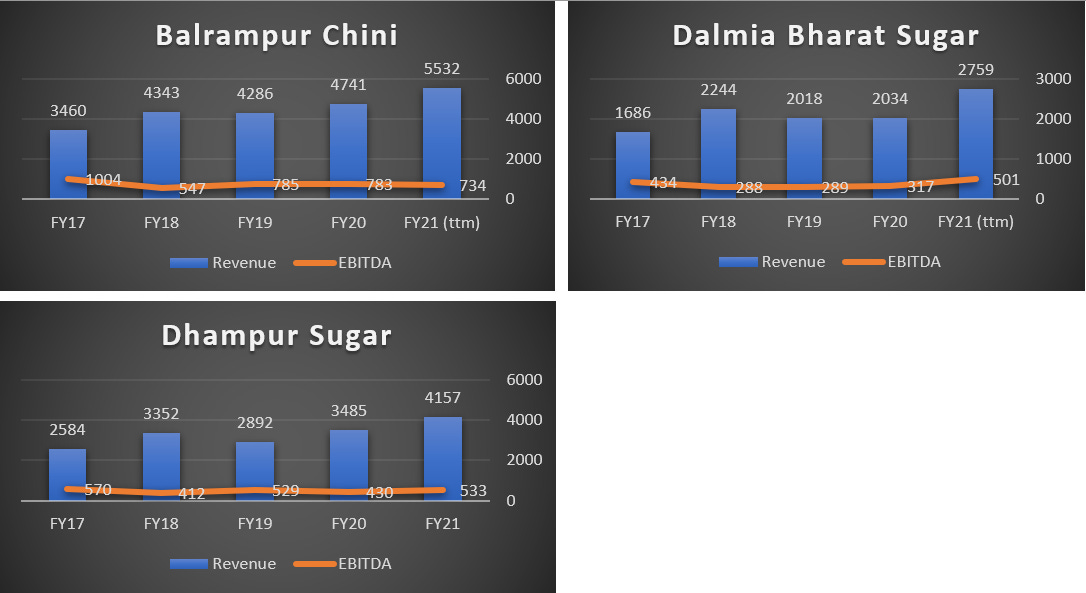

The revenues of these companies are prone to sugar prices, which have been under pressure in India since 2017-18 because of excess supply of sugar. However, increasing revenue share from ethanol, reduced sugar production in the industry (as capacities move towards ethanol) and higher selling price for this ethanol is expected to improve the margins for the companies between FY21 and FY25.

Being a cyclical industry, the EV/EBITDA is the key valuation ratio. Some players like Shree Renuka have high levels of debt while the more efficient players have debt to equity ratio < 1.

- On an EV/EBITDA basis, Balrampur Chini and Bannari Amman are 1000+ Crores marketcap companies trading at 10x to 12x multiples. Stocks like Dhampur Sugar, Dalmia Bharat Sugar and Triveni Engineering are trading at 5x to 6x multiples. These 5 mentioned names have a comfortable debt-equity ratio and free-cash flows that allow for capital expenditure on ethanol capacities.

- When a cyclical industry, such as Sugar, turns around towards favourable times, it is usually the smaller, debt-ridden players (who were making losses or had very low margins), who experience the best tailwainds as they are able to improve profitability, reduce debt and this delta gives them a re-rating.

- In cyclical stocks, timing is of utmost importance as the cycle can turn quickly. You wouldn’t want to be stuck with debt ridden and inefficient companies for the long term.

Balrampur chini is one of the best run sugar companies in India and the company generates strong cash flows, with which it has reduced debt in recent years. Dhampur sugar is a stock that we believe can get re-rated in this upcycle as the company has reduced the debt-equity ratio and EBITDA margins can improve with increase in Ethanol mix in revenues and improved realization from sugar. Investors may want to study the sector and stocks closely before taking an informed decision.

Disclaimer: None of the stocks discussed in the above post are recommendations to BUY or SELL. The discussion is simply done to study the Sugar industry in India.

https://pib.gov.in/PressReleasePage.aspx?PRID=1668399

No comments:

Post a Comment