In this post, we will study the business model of Power Grid Corporation of India and try to analyze what the stock price is worth as per academic models. This is not a research report or recommendation to BUY/HOLD/SELL the discussed stock.

Company Snapshot

Power Grid Corporation of India Ltd. was incorporated in 1989 with an aim to consolidate all power transmission assets of the country into a single entity. The company is a Maharatna PSU in which the Government of India owns a 51.34% stake. Power Grid sets up extra high volatage alternating current and high voltage direct current transmission lines and moves large blocks of power from power plants to load centers across different regions.

The company owns 1,70,724 circuit kilometers of transmission lines and 262 sub-stations.

Industry

The core players in the power sector are companies who generate, transmit and distribute power. Transmission companies like Power Grid connect the power generators to the distribution companies. And for this, they have to create transmission networks. The transmission sector in India comprises of inter-state and intra-state grids.

Private players have a 7.4% share (2020) of the total line length. Power Grid has a ~ 85% market share of the inter-state transmission market basis tariff charges and a ~45% share of the total power transmitted in the country, making it a critical asset for the Government of India. Of the new transmission lines added in 2021 (circuit kms), State Government owned companies had a 46% share, Central Government owned (Mostly Power Grid) had a 43% share while private players had a 11% share.

An issue that plagues this industry

Distribution companies, a.k.a “discoms”, enter into long-term purchase agreements with the power generation companies, a.k.a “gencos” and then sell this power to end users - industries and domestic consumers. However, due to political pressure and inefficient operations, they end up making losses. This spirals into discoms not honoring their purchase agreements and owing a lot of money to power generators.

This is largely the case with state-run discoms. Private discoms have better operating efficiencies and are able to pass on increase in costs to the end users. The Government of India came up with the UDAY scheme in 2015 with the aim to turnaround the state-run discoms by improving operational efficiency, reducing the cost of power and restructuring and refinancing the finances. The Covid pandemic came as a setback to the slowly improving fortunes of these discoms and the Government of India had to announce a special package of Rs 1.25 Lakh crores to help these discoms repay power generation companies. The Government has planned an outlay of Rs 3.03 lakh crore between FY22 and FY27 to make the state run discoms financially sustainable and operationally efficient.

Revenue Model

The company gets almost all its transmission revenues from state power utilities (SPUs). Although the company has other sources of income such as consultancy services and telecom networks, transmission charges contribute >90% of the income.

The other sources of income for the company are consultancy services (Rs 501 Crores in FY21) and telecom (Rs 707 Crores in FY21). The company operates in the telecom segment under the brand name PowerTel, providing Pan India overhead optical fiber network. The company is exploring business opportunities such as setting up data centers, using transmission lines for telecom purposes, etc. Currently, PGCIL is one of the companies helping implement Bharat Net, a project to connect Gram Panchayats by broadband.

Transmission business

The company builds transmission networks (grids) and maintains it. It then charges a fee from customers using its grid. Capex and Capitalization are two important terms to understand when studying Power Grid. Capex is the capital expenditure incurred towards building new assets. Capitalization is when the assets are ready-to-use and start generating revenues and cashflows for the company. So, there are years when the company incurs high capex and later years when these assets start making money for the company.

There are two types of projects: Regulated Tariff Mechanism (RTM) and Tariff Based Competitive Bidding (TBCB). The period of agreements are ~ 35 years, and the tariff charges are pre-decided by CERC. The revenue doesn’t depend on the volume of power flowing but on the availability of lines. Before the TBCB route came, Power Grid would work on a cost plus basis which meant that the company would recover the project cost. Off late, the incoming orders are equally split between RTM and TBCB. Under the TBCB route, the bidder with lowest annual levelized tariff is given the project for 25 years under a Build, Own, Operate and Maintain (BOOM) format. Reports peg Power Grid’s share of TBCB projects at 42% to 48%, showing its financial might. RTMs have a higher ROE of ~ 15% while TBCBs have a lower ROE of ~ 14%. The contribution of TBCBs to the PAT is currently 3% but is expected to be significant by the end of the decade.

Welcome InvITs - National Monetisation Pipeline

The Government is looking to monetize assets so that they have more money available for public welfare expenditures. As a part of this initiative, they planned a Rs 45,000 Crore transmission asset monetization by 2025.

Power Grid plans to use InvITs to monetize its TBCB assets. Why cannot RTM assets be monetized? Because they are regulated by CERC and ROEs can be tinkered with. So, investors might not really be open to putting money in RTM assets. The money that Power Grid receives from InvITs can be used to repay debt, undertake capex for growth or give dividends to shareholders. And the Government would really like dividends, to serve the purpose of this entire exercise.

Financial Analysis

The company’s revenues have grown at a CAGR of:

- Between FY18-21: 9.79% (Revenues) and 4.79% (PAT)

- Between FY16-21: 13.93% (Revenues) and 15.41%(PAT)

Power grid uses a 30% equity, 70% debt split for projects in most projects. The firm has maintained a debt equity ratio in the range of 2x-2.5x and enjoys a AAA rating. This helps improve the ROE for shareholders even though the IRR of some projects is a little above 10% and ROCE is ~ 11%.

The ROE and ROCE is in an improving trend. If we do a DuPont analysis of the ROE, we see that the improvement in ROE is from an improvement in Net-profit margins from 28.99% in FY17 to 30.36% in FY21 and increase in asset turnover ratio from 0.1371 to 0.1554. If the FY21 asset turnover is reduced to 0.14, the ROE falls from 17.88% to 16.18%.

Capitalization to Capex

Over the last decade, we see FY11-FY15 where the Capex was higher than the capitalization and then we have the FY16-FY21 period where the capitalization increased. Over the next 4-5 years, the capitalization is expected to be higher than the Capex.

Future Outlook

The per-capita consumption of electricity grew ~ 15% between 2016 and 2020 but is expected to grow ~ 30% between 2020 and 2025.

India’s installed capacity as per 2021 data is 382 GW but is expected to rise to 817 GW by 2030. The share of renewables is expected to increase from ~ 25% to ~54%. Power Grid is working on Green energy corridors in different phases and this segment provides a growth opportunity for the company. Other policies provide growth opportunities related to smart meters (to curtail AT&C losses), grids to support EV charging, battery storage, etc.

Smart Meter Project: The Government of India has a planned outlay of Rs 22,500 Crores for 25 Crore smart meters to be installed. This ~900 per meter will cover 15% of the cost of Smart Meters. The ROE on the smart meter project is pegged at ~ 14% and of the opportunity size of ~ Rs 1.5 Lakh Crores, Power Grid is targeting a capex of ~ Rs 15,000 Crores over the next 3-4 years in this segment.

Risks

- The CERC regulates the ROE that power transmission companies earn. This ROE fixed at 15.5% for 2019-24 can be lowered in the future by reducing the price charged to discoms. Any reduction in ROEs can hit the top-line, bottom-line and dividend payout to shareholders.

- The Government can step in and ask Power Grid to give discounts and rebates to discoms. The company gave a Rs 1,075 Crore rebate in Q1FY20 because of a fall in demand from the Covid-19 disruptions.

- In 2019, the private transmission companies approached the Competition Commission of India alleging that Power Grid has unfair advantages of access to funds and support from Government because of which it is indulging in predatory pricing in biddings.

Valuations

Current Market Price: Rs 204

Power Grid trades at a PE of 11.74x (5Y median 13.4) and an EV/EBITDA of 7.12. At current price, the stock trades a dividend yield of ~ 4.81%. The stock trades at a price-to-book ratio of 1.84.

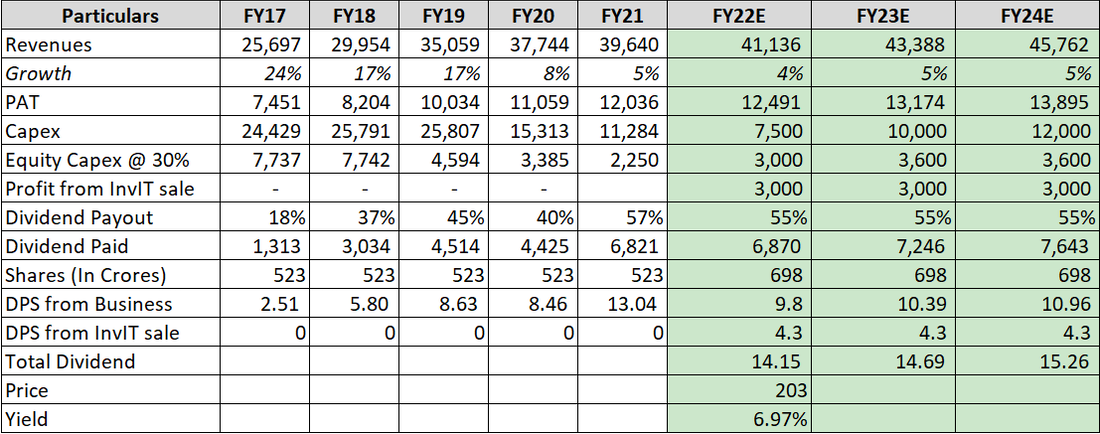

Going forward, with lower capex, increasing capitalization, planned monetization of TBCB assets and the removal of DDT, the management should maintain a dividend payout ratio of ~ 55%. This would translate to dividend per share of ~ 14.5 per share as calculated. This results in a dividend yield of ~ 6.97%. Over the next 3 years, the company could pay out dividends of Rs 44.10 per share.

Upside in dividend yield is possible if the company’s revenues grow faster than 5% p.a. and the dividend payout ratio is 60% - 65%.

If we value the company basis Dividends:

Assuming the above dividends for first 3 years, a terminal growth rate of ~ 5% and WACC of ~ 11.35% for dividends, we get the value of the stock at Rs 200 per share.

If we value the company basis Cashflows:

Taking the risk-free rate as 6.35% (10Y yield) and market risk premium of ~ 6.85%, we get an intrinsic value of Rs 268 per share. The market risk premium for India has been taken from Prof. Aswath Damodaran’s website. At current price, the stock trades at a ~ 24% discount to its intrinsic value.

Remarks

I believe that I have been conservative assuming the growth numbers and that the company will deliver higher growth numbers, basis improving financial fortunes of the discoms and higher capitalizations for PGCIL. Also, with the asset monetization the dividend payout ratio should be quite liberal. A dividend yield of ~ 6.5% to 7% and an upside potential in the stock price by ~ 8% p.a. is what investors can expect.

Disclaimer

This post is a breakdown of the discussed company’s business model. Raghav Behani has a holding in the stock discussed and can close positions in the future without intimation. The views and opinions are Raghav Behani’s personal and do not reflect his employer’s views.

No comments:

Post a Comment