This blog first appeared on our substack newsletter: https://dalalstreetbulls.substack.com/

Health insurance policies are tough to understand and that could be one of the reasons why 70% of medical expenses in India are out-of-pocket. Even the brilliant corporate executives out of India’s top universities have little idea about health insurance and believe that their “employer has them covered”. Your company’s health insurance is not adequate and you should buy one policy for yourself. Why? Read on.

A medical emergency where you had to pay Rs 2.5 Lakhs out of the Rs 4 Lakhs hospital bill, despite having a Rs 5 Lakhs insurance cover, could make you understand how health insurance works - or you could just do some research and make smart buying decisions when shopping for health insurance. This would save you lakhs! and also provide some respite in tough times.

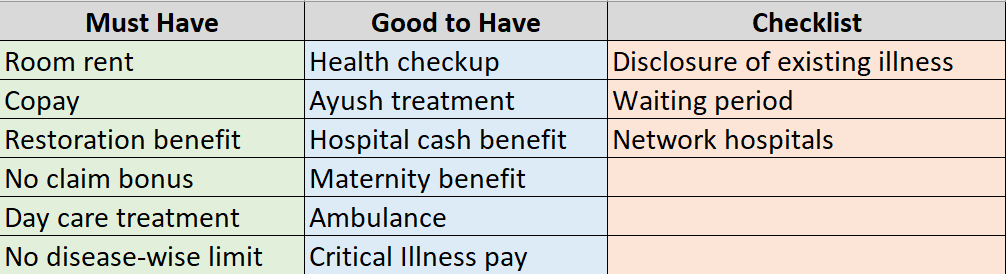

In this post, we will focus on the must haves and explain what it means for you. Lets start off with a scenario:

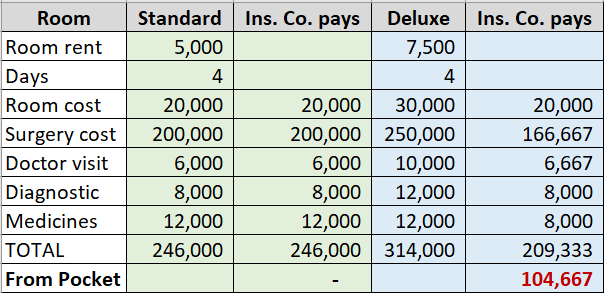

One day, your father complains of discomfort and chest pain. You sense something isn’t right and you rush him to the hospital. While admitting him, you know that he has a health insurance cover of Rs 5 Lakhs and it allows for 1% room rent allowance. The doctor informs you that your father will have to undergo a surgery and would be in hospital for 4-5 days. You have to select a room and you see that the Rs 5,000 per day room isn’t comfortable enough and you prefer the private AC room which costs Rs 7,500 per day. You assume that the extra Rs 2,500 per day would cost just Rs 10,000 to Rs 12,500 from your pocket for 4-5 days which isn’t a big sum for you. But when the final bill comes, you are in for a shock. The insurance company will play only a part of the bill and you will have to shell ~ Rs 1.04 Lakhs from your pocket.

Hospitals charge different sums for each service based on the rooms. The doctor visit, diagnostic charges, etc. will have different rates for a shared room, deluxe room, private room, etc. Only MRP products like medicines are charged same for all room types. Typically, a health insurance policy allows for a room that charges 1% of the insured amount (base coverage amount, not including top ups and bonus). So if you have a 5 Lakh insurance, then at 1% allowance you can choose a room that charges upto Rs 5,000 per day. Otherwise, the proportionate deduction kicks in at the time of claim settlement.

So what should you do?

- Go for a policy that has no cap on room rent; yes the premium might be higher but in the long run, you could save lakhs!

- If for some reason you are unable to take a policy with no cap, then choose a higher base coverage amount.

Your company’s health insurance policy of Rs 3 to 5 lakhs might have a cap on room rent and thus you could end up with a hole in your pocket in case of an emergency. In case of an emergency, will you go searching for a room that falls in your room rent budget? It won’t even be possible for you to decide which hospital to go to and you’ll end up going to the nearest possible hospital.

The insurance company offers you a sweet deal: A discount of 20% on the annual premiums if you opt for a 20% copay. You love discounts! And so you opt for a 10% copay.

At the time of admitting your father, you chose a room which falls in the limit specified by the insurance policy and now you’re expecting the insurance company to settle the entire bill. However, at the time of settlement, the insurance company tells you - We will pay only 80% of the bill, you have to pay 20% of the bill as you opted for copay of 20%. So lets share the bill!

You might have saved Rs 3,000 per year on the premiums but you end up paying 20% of Rs 2.46 Lakhs (Rs 49,200) because of the “copay” clause.

So your father walks out of the hospital fit and fine. The insurance company has paid Rs 2.46 Lakhs of the Rs 5 Lakhs. This policy had covered both of your parents. A couple of months later, your mother falls ill and needs hospitalization. The doctor tells you that the treatment might end up costing Rs 3 to 3.5 Lakhs. Now you’re worried that you will have to shell out a significant sum from your own pocket as only Rs 2.54 Lakhs of the policy remain unused. However, to your surprise, the insurance company says that because of the “restoration” feature provided by the policy, the assured amount has been restored to Rs 5 Lakhs. You heave sigh of relief!

For family floater plans restoration benefit is a MUST! Even for individual policies, you should have the restoration benefit.

If you don’t claim insurance in a year, the insurance company gives you a no claim bonus ranging from 10% of the sum assured to 50% of the sum assured. This step results in your coverage amount increasing step by step over 3-5 years. There is an upper limit till which your coverage can increases, usually 50% to 100% of the base assurance amount. Check the policy details for the no claim bonus percentage and upper cap. This bonus not just increases your coverage for the same amount of premium but also helps cope with the inflationary effects of medical costs.

Imagine paying Rs 80,000 for removal of appendix or some other surgery which didn;t require you to get admitted. You go to the insurance company to claim the money but they say - Well, you weren’t admitted for more than 24 hours so we aren’t giving you a penny. Yeah, some policies do not cover cost of surgeries that do not require hospitalization of more than 24 hours. These surgeries could be expensive and a lot of insurance holders are shocked when they realize that their policy doesn’t cover day care treatments. It is advisable to select a policy that covers day care treatments as well.

Some policies include the maximum limits on the amount they would pay for a surgery. For example, some policies mention that they will pay a maximum of Rs 2.5 lakhs for knee replacement, Rs 3 lakhs for a slip disk or only upto 50% of the sum assured in case of cancer.

Phew! While there are many more features that you can seek or details you can check before buying a policy, we have covered the features we believe are a MUST! As an individual, you need to evaluate your requirements, your premium budget and take a calculated decision based on the above must have’s.

Most plans do offer pre and post hospitalization expenses which would help you meet costs related to tests, checkups, etc. A critical illness add-on would give you a lumpsum amount if you are diagnosed with a critical illness. You may even want to choose a policy with a lower waiting period. If your premium budget allows then you can go well beyond the above mentioned must have’s.

No comments:

Post a Comment