TLDR: The pre-tax IRR of 22% translates to a post-tax IRR of 11% and is comparable to a return of 7.6% p.a. post tax. This investment is risky and is not a replacement for FDs and debt funds because it is locked-in till maturity (30-36 months).

I’ll try not to make this post too technical, but if 22% IRR turns out to ~ 7.6% p.a. then there will be fancy terms like IRR, CAGR and some mumbo jumbo involved.

Background

Lease finance & inventory finance is not new. For investors, these are high return avenues with large ticket sizes and carry moderate to high risk. Why moderate? Keep reading.. New age platforms such as gripinvest, wintwealth and others are bringing these investment avenues to retail investors. And on their website, investors see XIRR of 22% and most of them think they will make 22% post tax returns. This is not true! By the end of this post, you will understand how this investment model works, who it is for and how much can you expect to make?

How it works?

Businesses need funds to function and sometimes raising through equity or debt is not an option. So, if a company needs furniture or a machine for their office/factory, they can lease it. A lease can be an operating lease or a financing lease. Imagine, one of your friends wants to start a cab company but he doesn’t have any money to buy a car upfront and no bank will lend him money! So 5 of you pool in Rs 1 lakh each and buy a car worth Rs 5 lakhs and lease it out to him on the condition that at the end of every month, he will pay Rs 20,000 for the next 3 years. This is a win-win situation as:

- You all make money and the monthly returns are predictable

- He doesn’t have to borrow and can repay from his monthly earnings

What if he can’t repay? The 5 of you simply sell of the car and divide the proceeds amongst yourselves.

Companies raise funds through this route to keep their balance sheets asset light and their debt on balance sheet low. Lets say an EV startup wants to raise 10 Crores for buying batteries. Earlier the startup would approach HNIs and take lease finance from 2 partners contributing 5 crores each! But now platforms like Grip Invest bring this opportunity to retail investors by creating an LLP and taking contributions from retail investors (Minimum of 10,000 to 20,000) and making them partners. For the startup, they have to handle just 1 lessor and for Grip, they get bargaining power with OEMs (Original Equipment Manufacturers) to purchase assets and lease them.

How much money do you actually make?

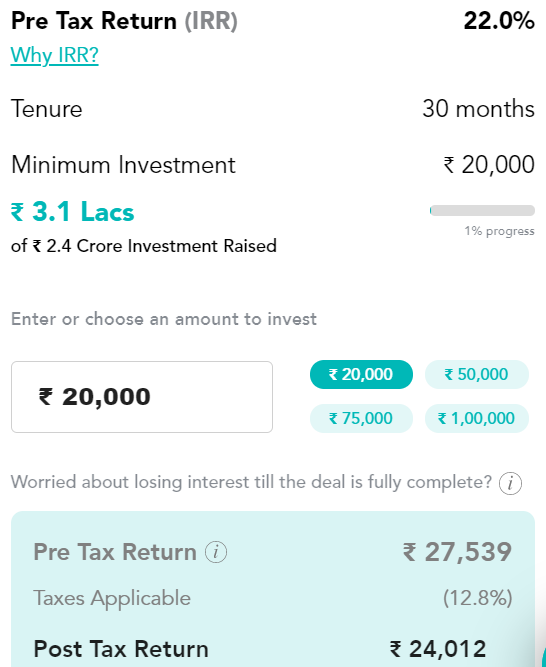

Lets talk of what’s in store for you. Is it 22% p.a.? No. Is it 22% IRR? No. Are these companies lying? No, not really. For better explanation, let me take you through an active deal on Grip Invest’s website.

First of all - Why IRR? Why not CAGR?

CAGR is used when there are few cash inflows and outflows. You invest Rs 50,000 in Dec ‘21 and you get back Rs 80,000 in Dec ‘24. Simple, your CAGR is 16.96%.

IRR is used when there are multiple cash flows. You invest Rs 50,000 in Dec ‘21 and you get back Rs 2,000 per month till Dec ‘24. Although you have received Rs 72,000, your IRR is ~ 29%. IRR as a number looks higher than CAGR but the final amount is lower. But before you jump to conclusions, IRR and CAGR comparison is apples to oranges kind of situation.

On excel, IRR is different from XIRR. Under IRR formula we don’t consider the dates of inflows and outflows but under XIRR formula we consider both cashflows and the dates of these cashflows. Thus when using excel, use the XIRR formula.

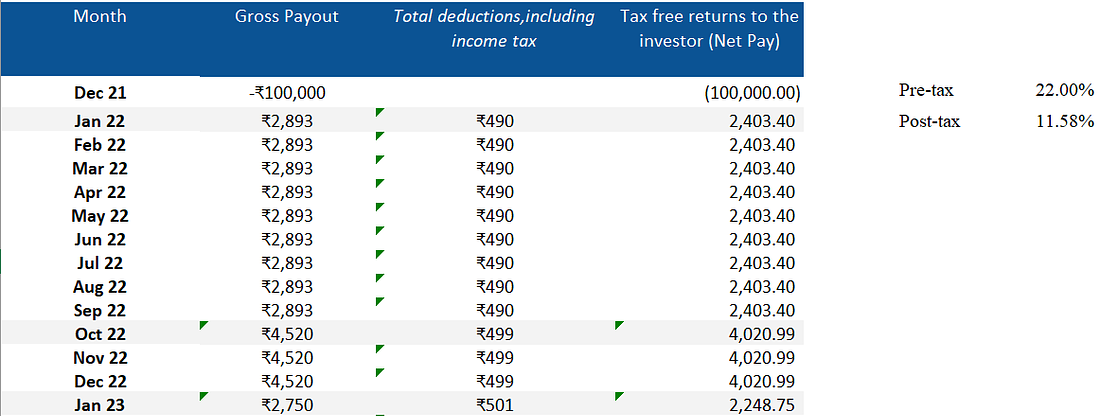

An example: Lets say you invest Rs 1,00,000 in December ‘21 in the active Furlenco deal on Grip Invest’s website. It mentions a pre-tax IRR of 22%. So, pre-tax you earn Rs 1,37,699 and post tax you get back Rs 1,20,063. While the pre-tax IRR is 22.00%, the post-tax IRR is 11.58% only. Yes - almost half!

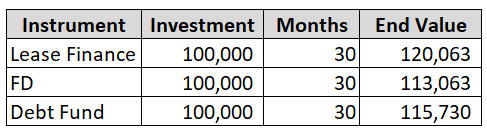

By putting in Rs 100,000 in Dec ‘21 I am getting Rs 1,20,063 post tax by Jun ‘24. This translates to just a 7.59% p.a. over 2.5 years. Debt mutual funds give ~ 6% p.a. post tax.

The last payout is of ~ Rs 41,000. At the end of the lease, as per the agreement Furlenco will buy the asset from the LLP at a pre-determined price and the last expected payout is based on the assumption of the LLP getting this amount. If at all Furlenco isn’t able to pay or underpays, then you might make significantly lower returns.

Someone whom I explained the above calculation to laughed it off saying how come I am getting only Rs 20,000 over 2.5 years when the company is paying Rs 2,400 per month! Won’t I make 20,000 in 9 months itself? I had to remind them that if the company stopped paying anything back after the 9th month, they would have paid 100,000 and got back 20,000 and thus lost a net of 80,000.

Taxation & Structure

The platforms at their end analyze and shortlist companies that they believe won’t go bankrupt and will pay lease timely. Then, they create an LLP (for each deal, a new LLP) in which the platform (or some one from their team) is the designated partner and all the retail folks (like you and me.. the Rs 20,000 investing people) are partners.

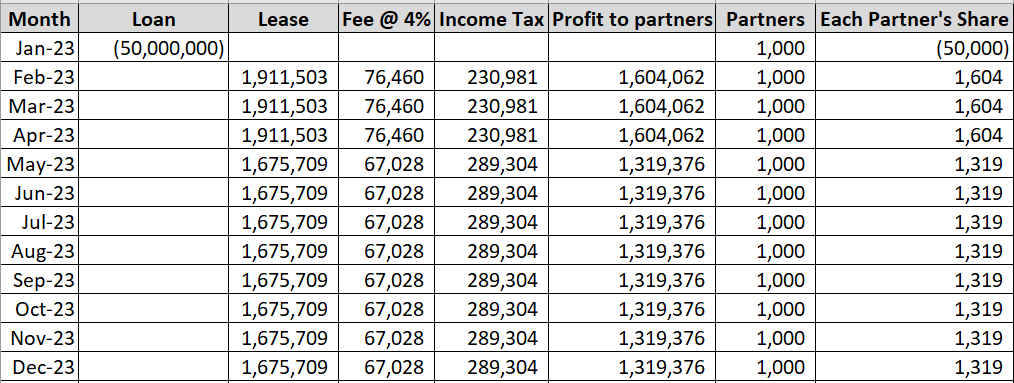

The platform takes a security deposit from the company they’ll be leasing assets to (usually 5% to 15%) and from whatever monthly lease they get, they charge a management fee and other expenses (ranging from 2% to 4% in total). Whatever remains is then distributed to all partners as profit! At the end of the lease, the lessee purchases the asset from the LLP at a price mentioned in the agreement.

As a partner in an LLP, you don’t have to pay any taxes on profits distributed. So, whatever monthly payout you get from this investment is tax-free but you have to disclose it in your ITR.

In the below table, we have taken an example of a 5 crore lease by an LLP with 1000 partners. Each partner has put in Rs 50,000 and they will receive Rs 1,604 post tax as profit from the LLP. They don’t have to pay any tax on this Rs 1,604 per month.

Is the company legit?

Grip Invest has raised funds from marquee VCs and Wint Wealth is backed by Zerodha. What they are doing is not Ponzi and they indeed are democratizing investing. They provide a platform to retail investors to diversify their fixed income portfolio with a high risk, high return product.

Risks

Credit Risk

These investments carry risk as the underlying companies are usually startups and most of them aren’t profitable. However, the platforms vet them well and seem to select only well-funded startups, which have achieved scale. There is moderate to high risk in this investment.

Almost 30-35% of the returns are in the last installment. If the lessee fails to pay the terminal value of the asset at the end of the lease to purchase it and keep it, you may lose money or make significantly lower returns.

Liquidity Risk

Once invested, there is almost no chance of redeeming your investments before maturity. The only way is to find someone else who is willing to buy the investment from you at the present value of all future cashflows. Basically, almost no liquidity. Some deals might have an exit opportunity after 24 months or the platform can provide and exchange for you to find buyers. Still, no to very low liquidity.

Tax

Although the returns from this investment are tax-free in your hand, they are still taxed at the LLP’s level and the tax reduces the IRR by almost half.

Returns

Currently, the returns are ~ 11% IRR and this at a time when these platforms don’t seem to be charging any fee (to get more investors onboard). Once they start charging a fee, the IRR would go down further to 7%-9%.

Reinvestment risk

Where will an investor put the money he/she receives from these investments? Will you end up spending it? Or will you start an SIP of this value? If I invest Rs 20,000 and get like a Rs 200 payout per month as payouts, there is nowhere I can invest Rs 200!

If you are below 40-45 years of age, your financial goal is majorly to grow your wealth and not make a monthly income out of it.

Alternative to debt mutual funds and FDs?

The CAGR of 7.59% p.a. as calculated is for comparing different investment avenues for a person who doesn’t need any monthly income from their investments. Lease finance would earn me an extra 1.5% p.a. but the are much riskier than debt funds AND you cannot redeem them in case of an emergency. For most investors debt investments are to meet short term liquidity or keep cash to shift to equities in case of a market fall.

Debt funds are diversified into papers of different companies and are always under regulator’s radar. My investment in lease finance could run into trouble if the company defaults payments or goes into a cash crunch. Startups are risky.

Even the hybrid-conservative funds (65 debt, 35 equities) can deliver higher returns over 3 years, than ~ 7.59% p.a.

Who should invest?

Typically if you are cash rich, have adequate exposure to equities and fall under the 30% tax bracket (for < 3 years investment), this investment might hold merit. It offers you more returns than FDs and most debt mutual funds. However, do take these points into consideration:

- Don’t put all funds into a single asset, diversify into 4-5 assets

- Don’t invest in assets that are longer than 3 years in duration

- Don’t think of this as an alternate to FDs and Debt funds, you can put ~ 10% to 15% of your fixed income portfolio for diversification

- Don’t expect to have liquidity on this investment

- Re-invest the monthly payouts if you don’t need it for your living expenses

Referral:

Even after considering the above risks, if you choose to invest / try out this investment, then click on this referral code and you will get Rs 2,000 (Dec ‘21 only, Rs 1000 after Dec ‘21) in your bank as a bonus after making your first investment.

Link: Grip Investment Referral Link

Referral code: RB6153

This was a great analysis! Thank you!

ReplyDeleteVery well thought out analysis, likes the point about risks and who should invest.

ReplyDeleteHowever there seem to be contradictions or missing info that leaves the taxation part confusing. In first examples the post tax return is 7.59% although it looks higher than that in second and theird table computations.

ReplyDelete