It is crazy but think of it - There is so much hype/buzz/chatter about IPOs but at the end of the day for most good IPOs, you have a small chance of allocation (~1% to 5%) and then if you get the allotment, the maximum value would be around Rs 15,000 (no, applying 12 lots instead of 1 lot neither increases the probability of allocation nor the quantum of allocation). So much discussion for a < 5% allocation chance of Rs 15,000 worth of shares? Even if the stock doubles on listing you’ll make only Rs 15,000 worth of notional gains. Think of it - How much money have you made by investing in IPOs over the last 5 years? So when you analyze consumer tech companies, think beyond just the IPO. Think from a long term perspective too.

IPOs are expensive (most of the times). Naturally - the promoter and early investors want to squeeze the last possible penny off their stake sale. The management wants to raise maximum possible cash with minimum dilution to fund their business ambitions. The merchant / investment bankers want the maximum possible commissions / fees. And when a bull market sets it, when every investor is making money, it opens up opportunities for companies to come up with their IPOs.It is the IPO season on Dalal Street!

One successful IPO of a much awaited business, where everyone (including retail investors) makes money, creates the demand for more IPOs. The media goes into a frenzy (to grab maximum eye balls), the bloggers and tweeters use this opportunity to grow their viewership and the stock brokers use this opportunity to onboard first time investors.

Like in every bull market, there is an IPO frenzy on Dalal Street this time too! This bull market we are witnessing the coming of age of Indian startups in the consumer technology space, that has influenced our daily lives. The likes of Zomato, Nykaa, PayTm, Policy Bazar, Oyo, Delhivery are either listed or in the pipeline. Companies which have made losses in the last 3 years can have only a 10% allocation to retail category in the IPO. 75% allocation is for QIBs and 15% for HNIs. So, the over-subscription for these IPOs is going as high as 50-100x meaning meagre odds of allocation for the retail investor.

Platform business + under-penetration in India viz-a-viz China and USA + growing share of online spends is one template you need to tell investors: Listen folks, don’t see the valuation. See the story, see the opportunity. And I won’t deny it. Some of these companies have the potential to create immense value for all stakeholders and money for shareholders.

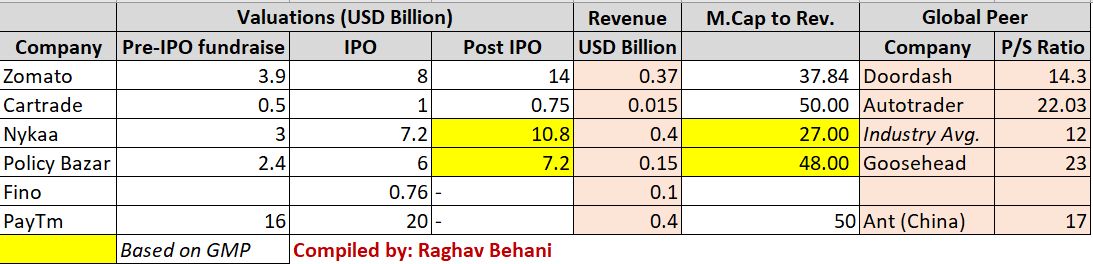

Phew! Trust me, while making the above table I was suprised. From talking of 15-18x PE a decade back, to talking 40-50x PS today! Soon we will be valuing on price to story.

BAAP (Buy At Any Price) works if the runway for high growth is long enough. But again, if there is scope for 30% p.a. growth over the next 10 years, won’t competition kick in and bring down growth to normal levels?

Life before and after listing.

Most of these companies are not making profits now and don’t even have a roadmap to profitability. Justified, as VCs never really asked for profitability - they wanted scale. However, the public markets will sooner or later demand a roadmap to profitability and won’t allow for quick pivots from one business model to another. You can compare it with life before marriage (random plans, flexibility, experimentation, etc.) vs. life after marriage (need prior approvals, need to communicate what’s on your mind, etc.).

These companies have reached a scale relying on deep discounts but cannot keep burning cash and diluting equity by raising more funds after listing. For them, the next task is to make existing users pay for services and at the same time maintain a 20%-30% p.a. or so growth rate for a decade.

Don’t boycott these IPOs

“On one side, there will be some who view a value of close to $20 billion (Rs 1,50,000 crore) for a company with a pittance in revenues, a history of operating losses and distracted management as insanity. On the other side, there will be some who feel that I am not giving the company credit for all of the new businesses it can enter, using its vast platform of users, and thus undervaluing the company,” - Aswath Damodaran on PayTm.

I believe that most of these startups will eventually destroy shareholder wealth, given their cash guzzling nature, the absence of a profitable core product and the limited pricing power. Out of these, we need to identify the ones that make long term investment sense. Every business model runs the risk of becoming obsolete or outperformed by new entrants. WazirX and Coinswitch Kuber have scaled up quickly to have a user base lager than Zerodha’s. This shows that in a tech driven world, moats aren’t strong enough.

We are anyways not going to get allotment for all the IPOs we apply to. So, as investors we have to study if these companies are worth investing in for the long term post listing. The post-listing valuations will be crazier than the IPO valuations (as these get listed at a premium to their issue price). Why miss out on potential listing day gains even if you don’t believe the long term story? But if you want to invest for the long term in the IPO and after listing, consider this:

Growth

Can the company grow at 20% to 30% p.a. over the next 8-10 years? While analyzing growth, you will also have to consider the user base that the company has. Presence across millions of smartphone users in India gives the company other avenues of growth, apart from their core business.

Road to profitability

Does the company have the ability to increase prices and reach breakeven / profitability? Or will users use the app less frequently if prices go up. Think on lines of this - Tomorrow if PayTm starts charging me a fee on money transfer, I’ll use Google Pay! Or if PayTm increases merchant fees, then the merchant will ask me to pay through Google Pay or debit card. If Zomato increases the delivery fee, I might Swiggy or Dunzo my food order.

Competition

Capital has flowed to the top 2 players in each segment and it is very tough for anyone beyond the top 3 to survive and scale up. But even duopolies are no guarantee of profitability. Look at Jio Vs Airtel or the Swiggy vs Zomato.

Founder

There is no metric you can judge the founder on. But charisma to raise capital when the going gets tough, the ability to negotiate hard on deals, the ability to build a strong team, the ability to see the future and serve the customers for what they want are some factors on which you can judge the founder.

End of the day, there will be backers and naysayers for all of these IPOs and companies post listing. The backers will talk of growth, the naysayers will talk of valuations. It is you as an investor who will have to take a call based on your conviction.

No comments:

Post a Comment